Under MACRA Medicare’s Proposed Rules, CMS anticipates that as many as 90 percent of providers will be part of MIPS’s first year, beginning January 1, 2017. That includes providers in ACOs that don’t bear enough risk for exemption, providers who reported PQRS and Meaningful Use, as well as those who did nothing, “waiting out” Medicare’s plans.

Not only is the wait over, but only about half a year remains until MIPS begins. And the challenges won’t fall evenly across provider groups. Size, specialty and support will weigh heavily into MIPS success. A customized MIPS strategy is your key to avoiding the 4 percent reduction in Medicare Revenues in 2019—a penalty that jumps to 9 percent in 2022.

The Four MIPS Components and How They Affect Your Score

MIPS combines three previous but separate Medicare value-based initiatives: PQRS, Meaningful Use and the Value Modifier (VM). Although streamlined, at first glance, these programs look very similar to their previous iterations, albeit with more integration. But wait, there’s more! CMS has added some special ingredients to help you understand, without any question, that the end goal is Risk—and that MIPS is your transition to Risk. There’s a 5 percent bonus for providers in Alternative Payment Models (APMs), which MIPS providers won’t receive. Then there’s the fact that APMs will get a higher base fee calculation in the future than MIPS providers.

It’s worth repeating: MIPS is your transition to Risk. So, to succeed in MIPS, you’ll need to meet program requirements and receive scores on each of four parts:

- Quality reporting on all patients (not just Medicare), using one of several reporting vehicles (or by having CMS review your claims)—50 percent of total MIPS score;

- Resource use calculation by CMS of all costs associated with patients attributed to you, and then compared against other providers—10 percent of total MIPS score;

- Clinical Performance Improvement Activities (CPIAs), such as pursuit of population health projects or other efforts to improve outcomes and lower costs—15 percent of total MIPS score;

- Advancing Care Information, using certified EHR technology to achieve better performance through such interconnectivities as public health reporting, e-prescribing of medication, coordination of care and patient electronic access—25 percent of total MIPS score.

In addition to reviewing these specific components, you need to understand the underlying themes that are critical to success under MIPS. Technology is the most important. Twenty-five percent of your MIPS score depends on having a certified EHR that is also able to connect with patients and outside entities. Successful quality reporting and clinical performance improvement are also highly dependent on technology that will give you ongoing reports of quality metrics, track patient outcomes and manage and measure your initiatives to improve performance. CMS cites Registries, Qualified Clinical Data Registries (QCDRs) and technology survey vendors as approved entities, in addition to EHRs, to help providers achieve MIPS.

Performance Improvement is a second key MIPS theme, both in terms of quality and cost. Under PQRS and Meaningful Use, many providers didn’t realize that CMS was calculating resource use and applying a penalty or incentive to the provider group based on their profile. VM calculation is based on Quality and Resource Use Reports (QRURs) that CMS provides to practices, which identify areas where the group falls below the mean. The QRURs provide the template for a Performance Improvement plan. The VM reappears in MIPS as a scored component and is reinforced by the CPIAs. This is how you will demonstrate that your group is making efforts to do better.

These two themes are essential to creating a strategy that will not only meet specific requirements but also prepare your organization to succeed in MIPS and under Risk.

How MIPS Success May Vary by Practice Size and Specialty Attributes

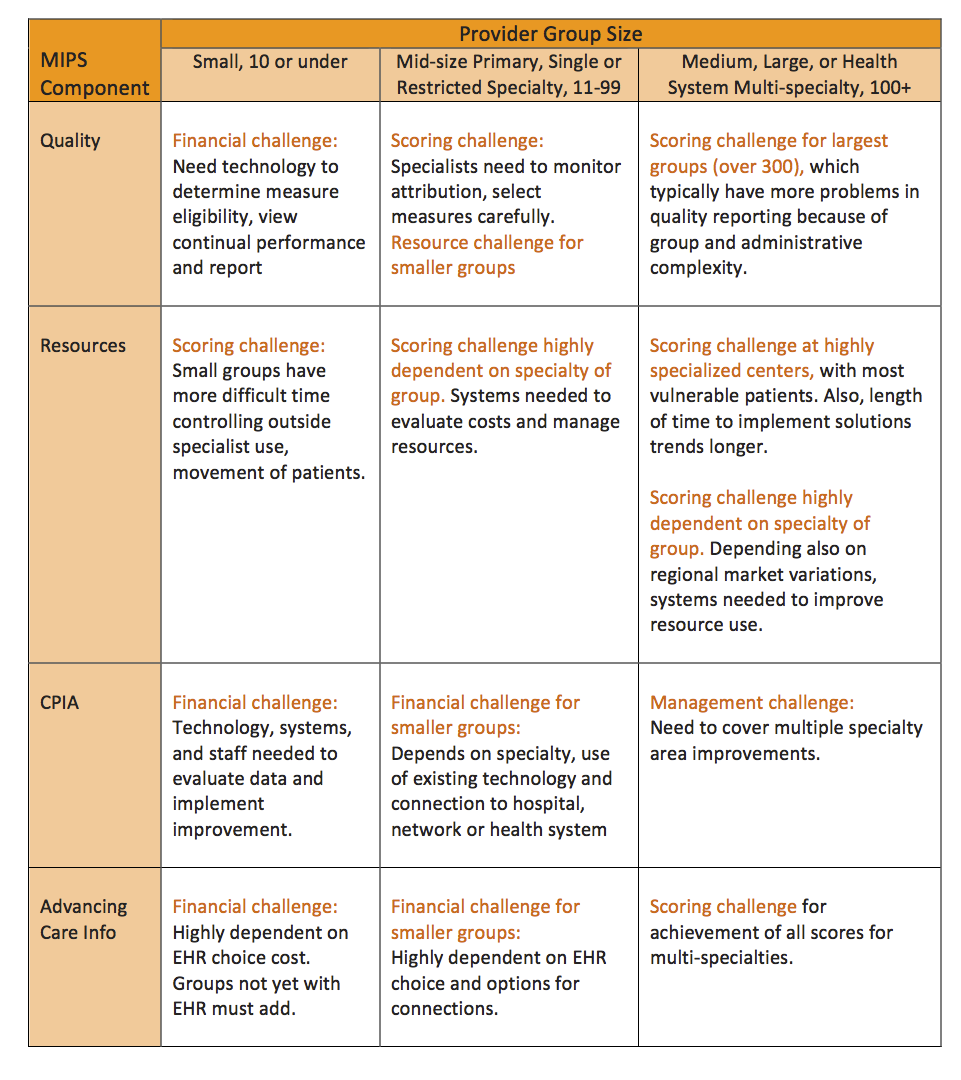

Now let’s take a look at some of the underlying requirements or calculations, as they affect practice size and extent of specialty. There are three possible challenges to confront within each MIPS component:

- Financial: affordability, pricing disadvantage for the size of the group, or unwillingness to pay to achieve the MIPS component;

- Management: difficulty in meeting the MIPS component stems from the complexity of the group and length of time to implementation;

- Scoring: barriers to achieving a positive score under MIPS.

Small Groups (10 or under)

Small groups, especially 10 providers or less, are the most likely to face financial challenges in meeting three of the four MIPS components: Quality, CPIA and Advancing Care Information.

Quality measurement and reporting requires technology to determine measure eligibility, view continual performance and then connect to a means of reporting. This quality technology could be a Registry, a QCDR or an EHR, but each will have a higher price per provider than for large groups. At a minimum, even the smallest group must implement an EHR as a cost of doing business, but this is often not the most advantageous for quality reporting.

While a small group may use claims reporting to meet this component, there is a huge disadvantage: the reporting approach remains invisible to the group because it is calculated solely by CMS, with no ongoing review mechanism to improve quality values. The group will not call or follow up with patients who have gaps in care or poor outcomes because they lack of a system to do so.

A certified EHR provides a mechanism to report quality, or to export the data to a Registry or QCDR. The latter two have the advantage of also being able to correct values or update values of missing data; in addition, they provide advice on the reporting of selected measures for optimization of the MIPS Resources component.

Small groups also face financial challenges for CPIA, because they either cannot or will not pay for population health or similar systems to improve patient outcomes as part of their EHR. An affordable solution will likely be a QCDR equipped with population health technology.

Advancing Care Information requires use of a certified EHR, as well as various connected recipients: patients with electronic access, e-Prescribing, specialized or other public health registries. Price is again the challenge; even if the group does have an EHR, some of these functionalities will require extra investments.

Small groups also may face a scoring challenge under Resources. Very small groups may have less control over what services patients receive outside the group. This is highly variable and depends on the provider’s practice style, the practice’s specialty and the patients.

Mid-size Primary Care or Single/Restricted Specialty Groups (11-99 providers)

At the lower end of this category, mid-size groups face similar issues as small groups for Quality, CPIA and Advancing Care Information. Larger mid-size groups have the internal support, purchasing power and depth of staff functions to have already adopted EHRs. They are also more likely to use Registries and QCDRs for quality reporting.

Nonetheless, CPIA and Advancing Care Information may continue to present financial challenges for even larger mid-size groups, partially because they require higher-end EHR functionalities, incur new and unanticipated costs, or necessitate functions that are perceived as unessential to the core mission or patient improvement. This is highly dependent on specialty and use of existing technology, as well as the group’s connection to a hospital, network or health system with access to staffing, systems and research.

Regarding Resources, mid-size primary care groups with specialty participation have the ability to manage some high-volume specialty resources, coupled with internal resources that can do more to control costs through referral management and the referring/referral network. Key is the group’s independent status or, if employed, the hospital’s cost orientation. Because hospital inpatient, outpatient and diagnostic services, along with referred specialty services, make up the bulk of costs attributed to the provider, it will take a common commitment to lower costs and improve quality to score well in this component.

Large Multi-specialty and Health System Groups (100+)

For bigger and more complex groups, MIPS success is determined more by management of the process and scoring than financial challenges. Despite more resources and staffing, very large groups often struggle with managing the detail of physician practices, usually have a more complex physician practice structure and have a harder time implementing initiatives. In addition, larger groups can be associated with academic institutions or those with vulnerable, high-risk populations; resources can present a scoring challenge for both single specialty and multi-specialty large groups attached to such institutions.

MIPS Quality will be a challenge for larger groups as well, especially in health systems where there are multiple institutions with various groups and specialties. Managing the performance measurement process, with many decisions on a tight timeframe, poses a challenge to this category, but especially for the largest groups.

If larger Health System provider groups are divided into business entities that fit into the Medicare scoring system (based on Tax Identification Number and Provider Number), meeting Quality, CPIA and Advancing Care Information will present another challenge. Each group must meet MIPS scoring criteria on its own, creating a potential obstacle in the Health System as performance varies. Analysis of QRURs to support performance improvement in the Resources component will likewise prove complex and require manual integration of data to provide a basis for interpretation.

Success Factor: Establish a Plan for MIPS Success

In general, small groups are at greatest risk of failure because of their inherent lack of resources to afford systems that will track quality and costs and help to implement performance improvement. Wherever possible, the clearest path to success may be to seek support and shared resources through alignments with networks, other groups and hospitals or health systems. Small groups that wish to remain independent can, of course, do so and thrive—but only if willing to spend for necessary systems to participate in Medicare, commercial quality payment efforts and risk-based models.

For small and mid-sized practices:

- Review QRURs with expert help. Retain consultants for a data-driven review of your QRUR. This is the key to understanding comparative performance, especially if you are a primary care physician. Specialists will also find the QRUR valuable for understanding how patients are attributed to you, so that you can ensure proper referrals to your practice and support the connection with a primary provider—and not assume unnecessary responsibility for costs.

- Engage a tech vendor for PQRS 2016 and MIPS. Review pros and cons of EHR, Registry and QCDR methods of reporting with your EHR and with Registry vendors. You need to understand the benefits and your vulnerabilities as a practice. Then engage as soon as you can—for PQRS 2016– so that you can predict your success under MIPS.

- Get certified EHR technology if you don’t have one. If you don’t have an EHR now, investigate options with your Health System and/or find out which EHRs are in use or being sponsored locally. Make sure that you know that your EHR will export data to a Registry, to a system or to others as you direct—before you purchase!

- Identify CPIAs that will be or are being pursued by your local network, hospital or affiliate. Find out if you can participate so that you can attest to the CPIA or if you can pursue it similarly on your own.

- For Advancing Care Information, make sure your EHR will connect to the various vendors, businesses and patients that you will need to manage under MIPS. Investigate QCDRs and Specialized Registries for public health reporting options, as well, to give you credit for that component.

For mid-size practices without financial concerns:

Investigate areas that will impact the MIPS Scoring under the four components:

- Perform a risk analysis of your cost and quality reporting via QRUR review with expert help.

- Engage a Registry for PQRS 2016 and for MIPS.

- Identify CPIAs with high associated costs in your QRUR, and choose among these for your MIPS CPIA initiatives.

- Reassess whether your EHR is still optimal for MIPS and/or APMs. In particular, this includes a review of your vendor’s underlying data structure and ability to export and connect (and willingness to do so without exorbitant extra pricing).

- Evaluate the provider business structure through TINs. Because both CMS and commercial health plans attribute costs and quality by TIN, this should be the basis for reviewing aggregate provider results as well as your MIPS strategies. You can’t produce a list by TIN of your providers in one afternoon? Stop, rethink your physician business structure, including how your providers will participate in APMs and MIPS going forward, and get expert advice on how to reorganize the structure in conjunction with the start of MIPS.

For large practices:

Large practices require the longest lead-time to succeed in MIPS. Notably, many large systems have begun Clinical Integration, Performance Improvement and even PQRS/VM and ACO programs that have helped to advance thinking and skills necessary for MIPS success. These approaches are far from universally successful, however, and you need a MIPS strategy that navigates the unique challenges facing large and complex organizations. Some recommendations for other categories apply, but this group of providers will have more challenges than others in controlling costs:

- Perform a risk analysis of your cost and quality reporting via QRUR review with expert help

- Engage a QCDR for GPRO QCDR Reporting or GPRO Registry reporting, by June 30, 2016.

- Evaluate the provider business structure through TINs. For this category of providers, you should consider consolidating TINs in a way that will ease your route into both APMs and into MIPS. Generally, your primary providers within a geographic region should be in a dedicated TIN for ease of structuring solutions that are MIPS and APM-friendly. Specialty providers may have one or more TIN, but need not be divided by TIN-specialty unless there are excellent reasons. Allow enough time for this evaluation and consolidation; this is not a three-click, afternoon project.

- Look for best-of-breed technology, not a one-size-fits-all solution. As a large system, you are better served by a roll-out strategy that depends on prioritized, tailored solutions to your problems, using vendors that have very specific expertise.

- Choose Specialized Registry reporting options to ensure that your providers will get credit for Advancing Care Information.

There’s a lot to digest, discuss and analyze as you plot your strategy. Bottom line: whatever the size and attributes of your provider group, getting started now is the first step to MIPS success.

Founded in 2002, ICLOPS has pioneered data registry solutions for improving patient health. Our industry experts provide comprehensive Solutions that help you both report and improve your performance. ICLOPS is a CMS Qualified Clinical Data Registry.

Contact ICLOPS for a Discovery Session.

Image Credit: Eric Feldman

Nice article. IT is going to play a bigger role in healthcare. I think it is going to help in making better decisions and choices.